LoanFront - Personal Loan App

LoanFront - Personal Loan App의 설명

LoanFront는 쉬운 EMI와 번거로움 없는 상환 옵션을 통해 즉시 개인 대출을 받을 수 있는 인도에서 가장 안전하고 신뢰할 수 있는 대출 앱입니다. LoanFront는 Vaibhav Vyapaar Private Limited의 디지털 제품입니다.

대출은 주로 자체 RBI 라이센스를 받은 NBFC인 Vaibhav Vyapaar Private Limited에서 빌려줍니다. (https://vaibhav-vyapaar.com) 및 2023년 11월부터 아래 파트너 NBFC에서도 대출을 제공합니다.

우리의 대출 파트너:

• Muthoot Finance Limited(https://www.muthootfinance.com/personal-loan)

• Bhawana Capital Private Limited(https://www.bhawanafinance.com/LoanFront.php)

LoanFront(https://loanfront.in)는 RBI의 디지털 대출 지침을 100% 준수하며 ISO 표준 및 CISA 인증을 받아 구축되었습니다. 가장 높은 평가를 받은 대출 앱 중 하나

적임

✅인도 국적

✅23세 이상

✅좋은 신용 점수(600점 이상)

✅월 ₹15,000 이상의 안정적인 수입

당신은 제공해야

👉셀카

👉PAN 카드

👉주소 증명용 정부 신분증 1개(운전면허증/유권자 ID/여권/Aadhaar 카드)

우리의 제품

온라인, 종이 없는 100% 디지털 제품이며 물리적 문서가 필요하지 않습니다.

1. 플렉시 개인 대출:

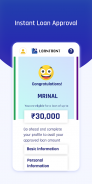

3개월에서 12개월까지의 기간으로 5분 안에 최대 ₹30,000까지 빠른 현금 대출을 받으세요.

2. 직장인을 위한 개인대출:

3개월~24개월 동안 최대 ₹2 Lakhs까지 개인 대출이 가능합니다. 또한 급여 또는 소득 증명과 고용 세부정보를 제공하세요.

금액, 보유기간, 수수료 및 요금(제품 세부정보)

⭐️대출 금액: ₹1,500 ~ ₹2,00,000

⭐️대출 기간: 3개월 ~ 24개월

⭐️이자율: 15.95% ~ 35.95% 매월 감소하는 원금 잔액에 따라 연 고정

⭐️처리 수수료: 위험 프로필 및 대출 금액에 따라 대출 금액의 1% ~ 7.5%

⭐️APR 범위: 위험 프로필에 따라 17% ~ 70%

*위약금은 예정된 납부가 지연된 경우에만 부과됩니다. GST는 인도 법률에 따라 수수료 구성요소에만 적용됩니다. 모든 고객은 제재 편지를 통해 KFS를 통해 이러한 세부 사항을 알게 됩니다.

대출을 이용하려면 어떻게 해야 하나요?

👉LoanFront 앱 설치

👉휴대폰번호와 이메일 아이디로 회원가입

👉앱의 다양한 옵션 중 하나를 사용하여 KYC를 수행하고 대출 자격을 확인하세요.

👉은행 계좌 제공

👉KFS(핵심 사실 진술)가 포함된 대출 계약서를 읽고 서명합니다.

👉은행계좌로 대출금액 받기

간편한 상환 방법

●UPI 앱(BHIM, Google Pay, Paytm, PhonePe, Amazon Pay 등) 및 Bharat BillPay - 수수료 0

●결제 게이트웨이 - RazorPay 및 Cashfree

●자동이체(eNACH/eMandate)

대표적인 대출 사례:

대출 금액: ₹50,000

임기: 12개월

이자율: 연 17.95%

처리 수수료: ₹1000(2%)

평생 등록비: ₹250(신규 고객에 대한 일회성 수수료)

수수료에 대한 GST: ₹225(18%)

지급 금액: ₹48,525

EMI: ₹4,583

총 상환액: ₹4,583 X 12 = ₹54,996

총 이자: ₹4,996

4월: 23.77%

총 대출 비용: ₹54,996 - ₹48,525 = ₹6,471

국내/해외 여행, 가정용 가구/가전 등 구매, 개인 긴급상황, 월별 청구서 지불, 결혼식 비용, 집 수리, 의료비, 보증금, 보증금이 필요하다면 걱정하지 마세요! LoanFront가 당신을 위해 여기 있습니다.

왜 LoanFront인가?

✔쉬운 적용 및 디지털 처리

✔담보나 신용카드가 필요하지 않습니다.

✔저금리 및 수수료

✔100% 안전하고 안전합니다. 연중무휴 24시간 이용 가능

✔조기결제 혜택

✔여러 대출 금액 업그레이드 옵션

✔완벽한 투명성을 갖춘 신뢰할 수 있는 앱

LoanFront App에서 제공하는 기타 서비스

• Centrum Broking Limited(https://www.centrumgalaxc.com)로 즉시 Demat 계좌 개설

LoanFront는 책임 있는 대출 관행을 따르며 다음 회원입니다.

☀️소비자 역량 강화를 위한 핀테크 협회 - https://faceofindia.org

☀️인도 디지털 대출 기관 협회 - https://www.dlai.in

고객 지원:

근무 시간: 오전 9시 30분 ~ 오후 6시 30분(월요일 ~ 토요일)

✉: support@loanfront.in

☎ : 08048126351

주소 : #1, Domlur Layout, Domlur 우체국 옆, Bangalore, Karnataka, 560071, India.